Stockport accountants, are advising that salary sacrifice benefits will change following a Government consultation carried out at the end of 2016. From 6 April 2017, legislation will limit the income tax and employer national insurance contribution (NIC) advantages where benefits are offered through a salary sacrifice arrangement apart from schemes involving pension saving, employer-supported childcare, cycle-to-work benefits and ultra-low emission cars (ULEVs).

How does a salary sacrifice scheme work?

Salary sacrifice schemes involve employees agreeing to reduce their salary in return for non-cash benefits, known as benefits in kind (BiKs). Whilst salary is chargeable to income tax and NICs, many BiKs are not. BiKs are therefore used by employers as a useful tool for rewarding their staff.

For instance, if an employer provides a director or employee with a mobile phone for private use, the benefit is exempt from tax and national insurance contributions. So if it is provided in addition to salary there is no extra tax or NICs liability.

It is the same where the employer has provided the phone under a salary sacrifice agreement: both the employer and employee save tax and NICs compared with the employee buying the same phone from their take-home pay.

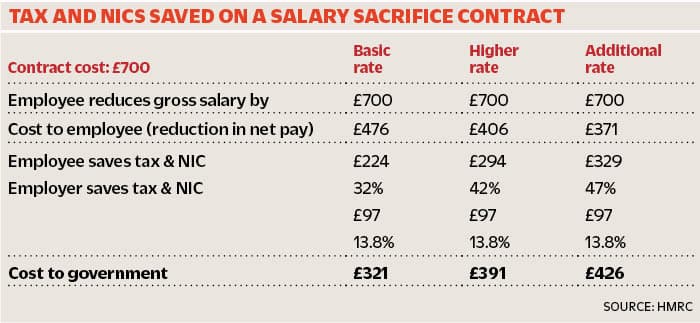

Case study: The £700 telephone contract

The table below shows the amount of tax and NICs saved on a telephone contract of £700 purchased through salary sacrifice by an employee in each income tax band, by an employer, and the overall cost to the Exchequer, according to HMRC.

Arrangement in place before 6 April 2017 will be protected until 6 April 2018, or when the contract comes to an end or undergoes modification, whichever is the earlier. Schemes involving cars, accommodation and school fees will be protected until 6 April 2021. If you would like to know you how you can use salary sacrifice to your advantage in the meantime, please don’t hesitate to contact our payroll team [email protected] or ring Sarah Harkness on 0161 456 9666.