New Tests And New Car Benefit Percentages

As part of its drive to encourage green motoring, the government has introduced a new emissions test, as well as new car benefit percentages.

As part of its drive to encourage green motoring, the government has introduced a new emissions test, as well as new car benefit percentages.

Legislation has been enacted to change reporting obligations for residential property gains chargeable on UK resident individuals, trustees and personal representatives.

Businesses that have been affected by the COVID-19 pandemic and are seeking to make use of the VAT deferral have been urged to cancel their direct debits ‘as soon as they can’.

On 17 March, Chancellor Rishi Sunak unveiled a £330 billion package of support for the UK economy as it combats the COVID-19 pandemic.

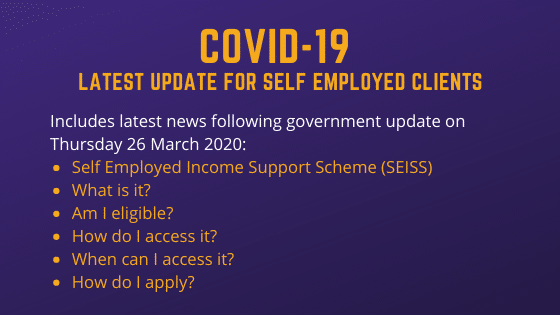

Self-employment Income Support Scheme (SEISS) – what we know at this moment in time. Communication to IN Accountancy clients March 26 2020 in relation to

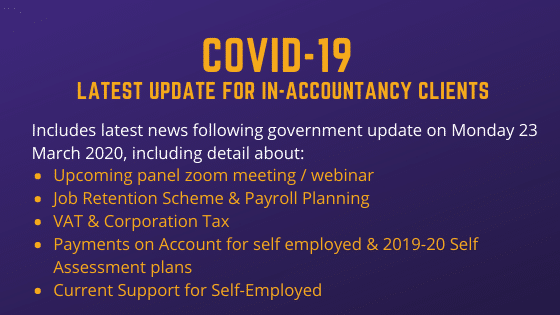

Just posting full text of the communication we sent to all clients on Monday evening in case anyone else finds it useful. Please feel free

With the end of the tax year looming there is still time to save tax for 2019/20.

New company car advisory fuel rates have been published which take effect from 1 March 2020.

The Institute for Fiscal Studies (IFS) has urged Chancellor Rishi Sunak to use the forthcoming Budget to raise taxes.

The 2020 Budget was presented to Parliament today amongst fears of an approaching Coronavirus pandemic. UPDATE: Download the full overview here: We will post a

The government has confirmed that reforms to off-payroll working rules for the private sector will go ahead from 6 April 2020.

The Government announced the introduction of a new 2% band for non-residential leases which will come into effect for contracts entered into on or after

Keep up to date with all the news, events and videos from IN Accountancy

2 Station View,

Rhino Court,

Bramhall Moor Lane,

Hazel Grove,

Stockport,

SK7 5ER

IN-ACCOUNTANCY

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!